Adjusting marketable securities to market value (mark-to-market)

Investment in marketable securities is classified as available for sale and is presented in the balance sheet using a valuation principle known as mark-to-market. According to this principle, an item is shown in the balance sheet at its current market value on the balance sheet date.

Unrealized holding gain/loss:

Unrealized holding gain/loss is an account that is used in mark-to-market valuation principle. It represents the difference between market value of securities and their cost.

When market value of securities are higher than their cost, the difference is known as unrealized holding gain. When, on the other hand, the market value of securities is less than their cost, the difference represents an unrealized holding loss.

When balance sheet is prepared, unrealized holding gain/loss appears as a component of the stockholders’equity. Unrealized holding gain is added to and Unrealized holding loss is subtracted from the stockholders’ equity.

Journal entries for adjusting marketable securities to market value:

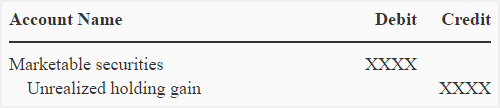

(1). When market value of securities is higher than their cost, marketable securities account is debited and unrealized holding gain account is credited. The journal entry for this is given below:

Example 1

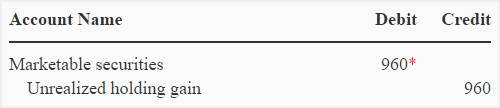

On December 31, 2022, Fine company holds 2,000 shares of Eastern company at a cost of $45.52. On the same date, the market value of a share of Eastern company is $46 per share.

Required: Prepare a journal entry to make mark-to-market adjustment of marketable securities held by Fine company on December 31, 2022. How will this entry impact the balance sheet on December 31, 2022?

Solution:

*(2,000 × $46) – (2,000 × $45.52) = 960

The marketable securities will be shown in the current assets section of the balance sheet at a value of $92,000 that is their current market value. The unrealized holding gain of $960 will be added to the stockholders’ equity in the stockholders’equity section of the balance sheet.

(2). When market value of securities is less than their cost, Unrealized holding loss account is debited and marketable securities account is credited. The journal entry is given below:

Example 2

Refer to example 1 and suppose the market value of securities is $44.50 per share on December 31 2022.

Required: Prepare a journal entry to make mark-to-market adjustment of marketable securities on December 31, 2022. How will this entry impact the balance sheet on December 31, 2022.

Solution:

*(2,000 × $45.52) – (2,000 × $44.50) = 2,040

The marketable securities will be shown in the current assets section of the balance sheet at their current market value of $89,000. The unrealized holding loss of $2,040 will be subtracted from the stockholders’ equity.

Leave a comment