Unadjusted trial balance

The unadjusted trial balance is a list of ledger accounts and their balances which is prepared after the preparation of general ledger but before the preparation of adjusting entries. It is the fourth step of accounting cycle and is usually prepared at the end of accounting period.

An unadjusted trial balance does not truly reflect the accrual-based balances of all accounts and is, therefore, not suitable for preparing publishable financial statements. Income statement, balance sheet and other financial statements prepared on the basis of this trial balance may not comply with the applicable financial reporting frameworks such as IFRSs and GAAPs. The auditors may refuse to accept and approve these statements due to their unreliability. After preparing adjusting entries, an adjusted trial balance is prepared that can be directly used for the preparation of many financial statements.

Format of unadjusted trial balance

The unadjusted trial balance consists of three columns. All account names are written in the first column, the debit balances are written in the second column and the credit balances are written in the third column. The accounts are listed in the order in which they appear in the general ledger.

A simple format of unadjusted trial balance is given below:

The total of the debit column of unadjusted trial balance must be equal to the total of the credit column. If they aren’t in agreement, it means that the trial balance has been prepared incorrectly or the journal entries have not been transferred to the ledger accounts accurately.

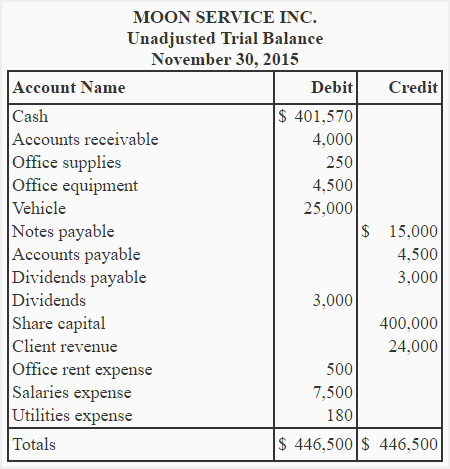

Example

We can prepare unadjusted trial balance from the ledger accounts of the Moon Service Inc. prepared on the general ledger page.

The purpose of unadjusted trial balance:

The main purposes of preparing an unadjusted trial balance is to check the mathematical equality of debits and credits.

If all the transactions have been correctly recorded in the general journal according to double entry principle of bookkeeping and have been correctly transferred to the ledger accounts, the total of the debit balances should be equal to the total of the credit balances of ledger accounts. An unbalanced trial balance, on the other hand, indicates one or more of the following typical errors:

- A debit amount has been incorrectly posted as credit or a credit amount has been incorrectly posted as debit.

- The balances of the ledger accounts have been incorrectly determined.

- The balances of ledger accounts have been incorrectly copied to the trial balance.

- A debit balance has been incorrectly listed in the credit column or a credit balance has been incorrectly listed in the debit column of the trial balance.

- The debit or credit columns of the trial balance has been incorrectly totaled.

The above errors are typical errors that an unbalanced trial balance can indicate. The students should keep in mind that the errors may still exist even if the totals of debit and credit columns of the trial balance are equal. Some examples of errors that a trial balance cannot identify are given below:

Examples of errors that will not be detected by trial balance:

- The transaction is not correctly analyzed and recorded. For example, the receipt of cash is erroneously debited to another account instead of cash.

- A transaction is completely omitted from the journal or ledger.

- The debit and credit amounts of a journal entry are equally overstated.

- The debit and credit amounts of a journal entry are equally understated.

We may conclude that if the trial balance is balanced, the errors may or may not exist; and if the trial balance is not balanced, the errors certainly exist.

Leave a comment