Retirement of treasury stock

The companies buyback their own shares (treasury stock) with the intention to either retire them permanently or reissue them at a future date. This article explains the retirement of treasury stock under cost method and par value method. If you want to understand how shares from treasury stock are reissued, please read the following articles:

- Purchase and sale of treasury stock under cost method

- Purchase and sale of treasury stock under par value method

Retirement of treasury stock-cost method

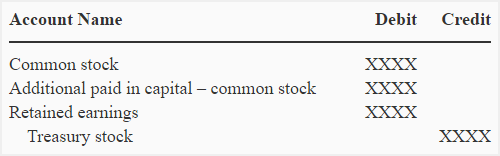

Under cost method, the journal entry for the retirement of treasury stock is made by debiting the common stock with par value of shares being retired, debiting additional paid-in capital (if any) associated with the shares being retired and crediting treasury stock with the cost of shares being retired.

If the repurchase price of shares is higher than their price at the time of original issuance, the credit part of the journal entry exceeds the debit part and in that case retained earnings account is debited with the balancing amount to make the debit and credit part of the entry equal.

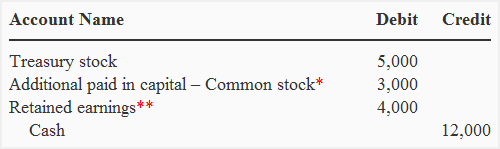

The journal entry for the retirement of treasury stock under cost method usually looks like the following:

Retirement of treasury stock – par value method:

Under par value method, the common stock is debited and treasury stock is credited with the par value of shares to be retired. The journal entry for the retirement of treasury stock under par value method looks like the following:

Consider the following example for a better explanation of the retirement of treasury stock under two methods.

Example:

The American company issued 5,000 shares of its $5 par value common stock at $8 per share. Later, the company bought back 1,000 shares at $12 per share and immediately retired them.

Required: Prepare journal entries for issuing, buying back and retiring the shares assuming the company accounts for treasury stock related transactions using:

- cost method.

- par value method .

Solution:

Journal entries under cost method:

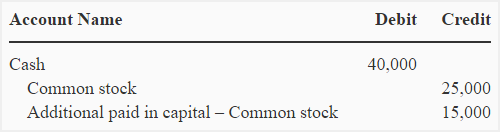

(1). When 5,000 shares are issued:

(2). When 1,000 shares are bought back – cost method:

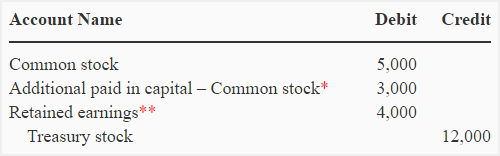

(3). When 1,000 shares are retired – cost method:

*Additional paid in capital associated with 1,000 shares: 1,000 × ($8 – $5).

**Retained earnings account has been debited with the remaining amount: ($12,000 – $5,000 – $3,000).

Journal entries under par value method:

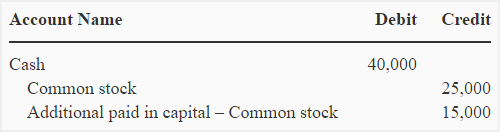

(1). When 5,000 shares are issued:

(2). When 1,000 shares are bought back – par value method:

*Additional paid in capital associated with 1,000 shares: 1,000 × ($8 – $5).

**Retained earnings account has been debited with the remaining amount: ($12,000 – $5,000 – $3,000).

(3). When 1,000 shares are retired – par value method:

We redeemed capital stock at face value (amount paid at issue) No gain or loss.

The Sub S Corp. will be discontinued.

How is this shown on 1120S and Stockholderts individual returns.

Thank you