Recognition of accounts receivable

The journal entry for recording accounts receivable

When goods are sold on credit, accounts receivable account is debited and sales account is credited. The price at which a credit transaction is recorded is the price due from customer and is known as exchange price. An invoice is issued by the seller to the buyer as an evidence of the transaction. It contains all necessary details such as date of transaction, type of product sold, payment terms, per unit price, total price and the quantity sold etc. The invoice is an essential document because it provides necessary information to both sellers and buyers for entering the transaction in their accounting records.

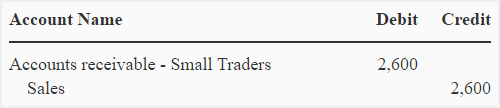

The journal entry that is passed for a credit sale transaction is given below:

Example 1

The Big company sold 5 batteries to Small traders on credit @ $200 per battery.

Required: Prepare a journal entry to record the above transaction.

Solution:

Cash discount:

The cash discount (also known as sales discount) is the relaxation in price that sellers offer to buyers to induce them for making payments promptly. For example, a payment term expressed as 1/10, n/30 means that the buyer will be entitled to a cash discount of 1% if he makes the payment within 10 days otherwise the gross amount is payable in 30 days. Different sellers use different payment terms depending on the nature of their business, creditworthiness of customers and their own credit policies.

In the books of sellers, the cash discount is handled using one of two methods – gross method and net method. These are briefly explained and exemplified below:

Gross method

Under gross method, the sales transaction is recorded at gross price i.e., without deducting the amount of discount offered. The accounts receivable account is debited and the sales account is credited with the gross amount. Afterward, if buyer makes the payment within discount period, the seller allows him a discount according to the terms of sale; but if he fails to make the payment within discount period, then no discount is allowed to him.

Net method

Under net method, the sales are initially recorded with the net amount i.e., after deducting the amount of discount from the gross price. The accounts receivable account is debited and the sales account is credited with the net amount.

For further explanation and journal entries that are made under both the methods, consider the following example.

Example 2

The Big company sells goods to Small traders on account at a total price of $2,600. The payment terms for this transaction are 2.5/15, n/30.

Required: Make journal entries under gross method and net method assuming:

- Small traders make payment within discount period.

- Small traders make payment after the discount period but within 30 days of invoice.

Solution:

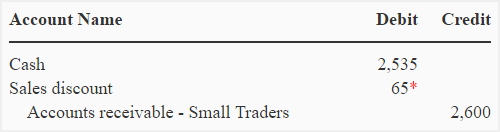

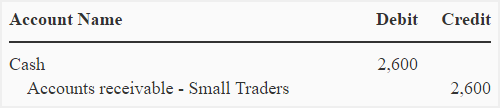

(1). Journal entries under gross method

When the goods are sold:

When payment is made:

(i). If Small Traders make the payment within discount period:

*2,600 × 2.5%

(ii). If Small Traders make the payment after discount period but within 30 days on invoice date:

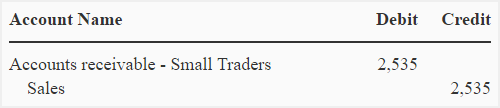

(2). Journal entries under net method

When the goods are sold:

When payment is made:

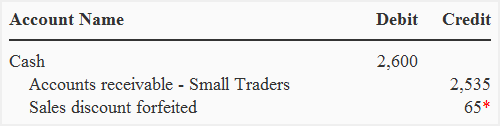

(i) If the payment is made within discount period:

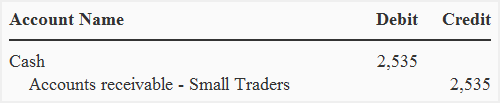

(ii) If the payment is made after discount period:

*2,600 × 2.5%

The sales discount account is a contra revenue account. The sales discount recognized under gross method is deducted from the gross sales revenue in the income statement and sales discount forfeited recognized under net method appears as income in the “other revenues” section of the income statement.

Leave a comment