Purchase of marketable securities

Companies purchase marketable securities mostly with the aim to earn some income from their extra cash. Holding unused cash in hand or in a current account is not a good choice because it would not generate any financial return for the business. Smart entities often invest their extra cash in short-term marketable securities which generate interest or dividend income for them. These securities are issued by government or other commercial entities and can be easily sold in secondary financial markets for quick cash.

In this article, we will look into how companies journalize the acquisition of marketable securities and how it impacts their statement of cash flows.

Journal entry for the purchase of marketable securities

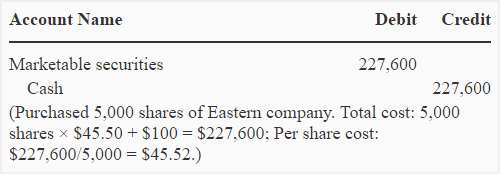

When marketable securities are purchased, marketable securities account is debited and cash account is credited. The transaction is recorded at cost including any brokerage commission paid to acquire these securities.

The journal entry would be made as follows:

Example

Fine Company purchases 5,000 shares of Eastern Company for short-term investment at the rate of $45.50 per share on December 1, 2022. It also pays a brokerage commission of $100 for the purchase of these shares.

Required: Prepare a journal entry to record the purchase of these shares.

Solution:

Notice that the per share cost ($45.52) has been computed after adding the brokerage commission ($100) to the total cost of shares ($227,500). This per share cost basis will be used to calculate any gain or loss at the time of sale of these shares.

Marketable securities account is a control account. For instance, if Fine Company acquires the shares of another company, it will record a similar journal entry (i.e., marketable securities will be debited and cash will be credited). A marketable securities subsidiary ledger account will, however, be required in the books of Fine Company to keep a separate record of the securities of each company.

If a company holds all or part of its marketable securities at the end of its reporting period, it must report the investment in these securities in its balance sheet as current asset. According to US GAAP, investment in marketable securities is disclosed at their current fair market value, not at original or historical cost. In above example, suppose if the market worth of shares held by Fine Company is $230,000 on December 31, 2022, the company would adjust the value of its investment from $227,600 to $230,000 by recording an unrealized holding gain of $2,400 (= $230,000 – $227,600).

The journal entry needed to recognize the unrealized holding gain (or loss) and adjust the marketable securities to their current market value has been given on this page.

How does purchase of marketable securities impact the statement of cash flows?

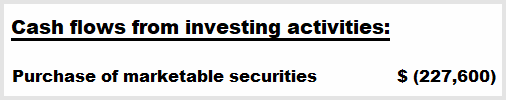

The cash used to purchase marketable securities is essentially an investing cash outflow and is reported as such in investing activities section of the statement of cash flows. The line item used for reporting purpose is “purchase of marketable securities”.

In above example, the cash amounting to $227,600 paid by Fine Company to acquire 5,000 shares in Eastern Company may be reported in the statement of cash flows as follows:

You can learn more about investing cash flows here.

Leave a comment