Exercise-9 (CM ratio, degree of operating leverage, break-even point)

ECG Company sells lightweight tables. One table is sold for $45. Variable and fixed expenses data is given below:

- Variable expenses per unit: $18

- Fixed expenses per year: $540,000

Required:

- Compute contribution margin ratio (CM ratio).

- Compute break-even point in dollars using CM ratio computed in part 1.

- Using the CM ratio computed in part 1, find the expected increase in net operating income if sales revenue increases by $135,000.

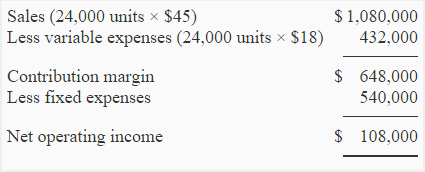

- During the last year, ECG company sold 24,000 lightweight tables. Compute the degree of operating leverage at the last year’s level of sales. If ECG manages to increase its sales by 15% next year, by how much should net operating income increase? (Do not prepare an income statement, derive your answer by using the degree of operating leverage).

Solution:

(1) Calculation of CM ratio:

Contribution margin = Selling price – Variable expenses

= $45 – $18

= $27

Contribution margin ratio (CM ratio) = Contribution margin/Sales

= $27/$45

= 0.60 or 60%

(2) Calculation of break-even point:

Break-even point in sales = Fixed cost/CM ratio

= $540,000/0.60

= $900,000

(3) Increase in net operating income:

= $135,000 × 0.6

= $81,000

(4) Degree of operating leverage:

Degree of operating leverage = Contribution margin/Net operating income

= $648,000/$108,000

= 6

The degree of operating leverage is 6 which means if sales increase by 15%, there will be a 90% increase in net operating income, as computed below:

Increase in net operating income = Percentage increase in sales x Degree of operating leverage

= 15% × 6

= 90%

Good learning