Exercise-8 (Computation of actual hours worked by working backward)

Exenco Global is a large company that produces a lot of products. One of the product is a paint that is stored in containers. The variable standard cost per container is given below:

| Quantity / Hours | Per liter / Per hour | Standard cost | |

| Direct materials | 6 liters | $2 | $12 |

| Direct labor | 1 hour | $9 | $9 |

| Variable manufacturing overhead | 1 hour | $6 | $6 |

| ——– | |||

| $24 | |||

| ——– |

The direct materials to produce this product is available in liquid form. During May, 60,000 liters of direct materials were purchased and 38,000 liters were sent to production department. The production for the month of May was 6,000 containers.

The following costs were incurred during May.

| Actual cost of materials purchased | $114,000 | |

| Actual direct labor cost | $55,900 | |

| Actual variable manufacturing overhead cost | $40,950 | |

| Variable manufacturing overhead efficiency variance | $3,000 | Unfavorable |

Required:

- Compute actual direct labor hours worked during the month of May.

- Compute variable manufacturing overhead spending variance.

- Prepare journal entries to record materials and labor related activities during May.

Solution:

(1) Actual direct labor hours worked during May:

| Standard hours allowed at standard rate (6,000* hours × $6) | $36,000 |

| Add unfavorable efficiency variance | $3,000 |

| ——– | |

| Actual hours worked at standard rate | $39,000 |

| ——– | |

| Actual hours worked = Actual hours worked at standard rate / Standard rate= $39,000 / $6= 6,500 hours | |

*6,000 containers × 1 hour

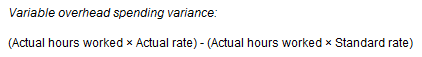

(2) Variable manufacturing overhead spending variance:

= (6,500 hours × $6.3) – (6,500 hours × $6)

= $40,950 – $39,000

= $1,950 Unfavorable

(3) Journal entries to record materials and labor related activities:

| To record direct materials activities: | ||

| Direct materials | 120,000 | |

| Direct materials price variance (See computations below) | 6,000 | |

| Accounts payable | 114,000 | |

| ———————————- | ||

| Work in process | 72,000 | |

| Direct materials quantity variance (See computations below) | 4,000 | |

| Direct materials | 76,000 | |

| To record direct labor activities: | ||

| Work in process | 54,000 | |

| Direct labor efficiency variance (See computations below) | 4,500 | |

| Direct labor rate variance (See computations below) | 2,600 | |

| Wages payable | 55,900 |

———————————-

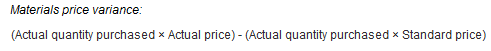

= $114,000 – (60,000 liters × $2)

= $114,000 – $120,000

= $6,000 Favorable

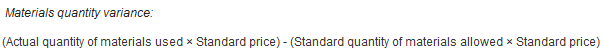

= (38,000 liters × $2) – (36,000 liters × $2)

= $76,000 – $72,000

= $4,000 Unfavorable

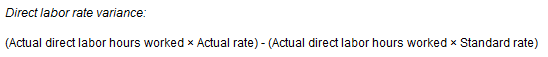

$55,900 – (6,500 hours × $9)

= $55,900 – $58,500

= $2,600 Favorable

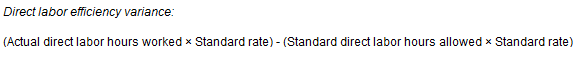

= (6,500 hours × $9) – (6,000 hours × $9)

= $58,500 – $54,000

= $4,500 Unfavorable

Leave a comment