Exercise-6 (Variable costing income statement and reconciliation)

Learning objective:

This exercise illustrates the preparation of variable costing income statement when absorption costing income statement along with necessary additional data is given. It also illustrates how we can reconcile the net operating income determined under variable and absorption costing approaches.

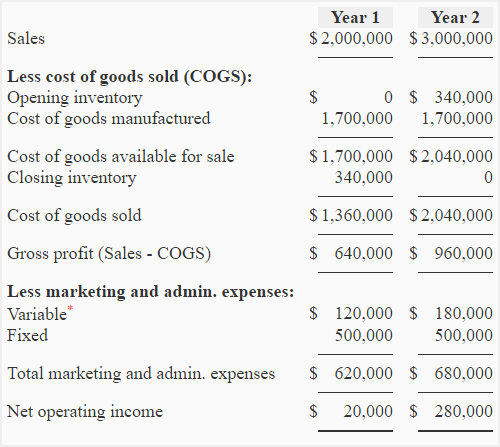

The absorption costing income statement of Arora Company for first two years of operation is given below:

*Variable marketing and administrative expenses are $6 per unit sold.

The manufacturing cost per unit is as follows:

- Direct materials: $16

- Direct labor: $20

- Variable manufacturing overhead: $4

- Fixed manufacturing overhead: $28

Sales and production data for two years is given below:

Units produced:

- Year-1: 25,000 units

- Year-2: 25,000 units

Units sold:

- Year-1: 20,000 units @ $100 per unit

- Year-2: 30,000 units @ $100 per unit

Required:

- Prepare a variable costing income statement using above information.

- Reconcile the net operating income figures produced by two costing systems.

Solution

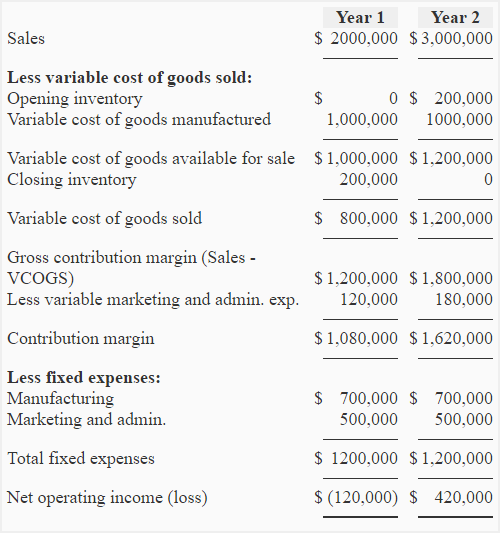

(1) Variable costing income statement:

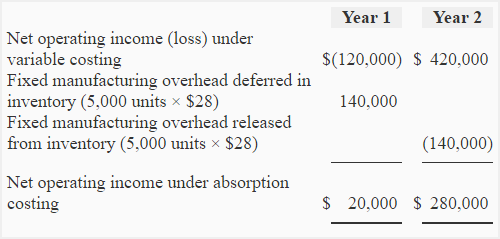

(2) Reconciliation of net operating income:

The inventory has increased by 5,000 units in year-1 and decreased by 5,000 units in year-2. So, in order to reconcile the net operating income under two costing approaches, we can start with variable costing net operating income and arrive at absorption costing net operating income. For this purpose, we need to:

- add the fixed manufacturing overhead deferred in 5,000 units of inventory in year-1 to the variable costing net operating income, and

- deduct the fixed manufacturing overhead released from 5,000 units of inventory in year-2 from the variable costing net operating income. The reconciliation schedule for year-1 and 2 is given below:

I have understood the concepts of variable and absorption costing