Predetermined overhead rate

Predetermined overhead rate is used to apply manufacturing overhead to products or job orders and is usually computed at the beginning of each period by dividing the estimated manufacturing overhead cost by an allocation base (also known as activity base or activity driver). Commonly used allocation bases are direct labor hours, direct labor dollars, machine hours, and direct materials cost incurred by the process.

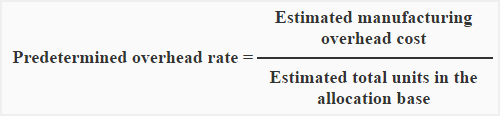

Formula:

As stated earlier, the predetermined overhead rate can be derived by dividing the manufacturing overhead cost estimated (or budgeted) at the start of the period by the estimated units in allocation base. The formula can be written as follows:

Examples of predetermined overhead rate

Example 1:

Suppose GX company uses direct labor hours to assign manufacturing overhead cost to job orders. The company’s budget shows an estimated manufacturing overhead cost of $16,000 for the forthcoming year. The company estimates that 4,000 direct labors hours will be worked in the forthcoming year.

Using the above information, we can compute the predetermined overhead rate as follows:

Predetermined overhead rate = Estimated manufacturing overhead cost/Estimated total units in the allocation base

Predetermined overhead rate = $16,000/4,000 hours

= $4.00 per direct labor hour

Notice that the formula of predetermined overhead rate is entirely based on estimates. The overhead applied to products or job orders would, therefore, be different from the actual overhead incurred by jobs or products. The comparison of applied and actual overhead gives us the amount of over or under-applied overhead during the period which is eliminated through recording appropriate journal entries at the end of the period. This procedure has been exemplified here.

The elimination of difference between applied overhead and actual overhead is known as “disposition of over or under-applied overhead”.

Example 2

Albert Shoes Company calculates its predetermined overhead rate on the basis of annual direct labor hours. At the beginning of year 2021, the company estimated that its total manufacturing overhead cost would be $268,000 and the total direct labor cost would be 40,000 hours. The actual total manufacturing overhead incurred for the year was $247,800 and actual direct labor hours worked during the year were 42,000.

Required:

- Calculate Albert’s predetermined overhead rate for the year 2021.

- Find the amount of manufacturing overhead cost that Albert would have applied to its units of product.

Solution

1. Predetermined overhead rate:

Estimated manufacturing overhead/Estimated direct labor hours

= $268,000/40,000 hours

= $6.7 per direct labor hours

2. Manufacturing overhead applied to products:

Actual direct labor hours worked x Predetermined overhead rate

= 42,000 hours x $6.7

= $281,400

Example 3

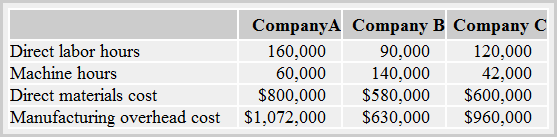

The estimated operating and cost data for three different companies is given below:

The allocation bases used by above three companies for computing their predetermined overhead rates are:

- Company A: Direct labor hours

- Company B: Machine hours

- Company C: Direct materials cost

Required: Compute predetermined overhead rate for each of the above three companies.

Solution

Company A:

Estimated manufacturing overhead cost/Estimated direct labor hours

$1,072,000/160,000 hours

= $6.7

Company B:

Estimated manufacturing overhead cost/Estimated machine hours

= $630,000/140,000 hours

= $4.5

Company C:

Estimated manufacturing overhead cost/Estimated direct materials cost

= $960,000/$600,000

= $1.6

Multiple or departmental predetermined overhead rates:

The predetermined overhead rate computed above is known as single or plant-wide overhead rate which is mostly used by small companies. In large ones, each production department computes its own rate to apply overhead cost. The use of multiple predetermined overhead rates may be a complex and time consuming task but is considered a more accurate approach than applying only a single plant-wide rate.

According to a survey 34% of the manufacturing businesses use a single plant wide overhead rate, 44% use multiple overhead rates and rest of the companies use activity based costing (ABC) system.

Example 4

The Blue Company uses a job order costing system and computes separate predetermined overhead rates for its cutting and finishing departments. The following estimates were made at the beginning of the year 2021:

Cutting department:

- Direct labor hours: 6,000 hours

- Machine hours: 48,000 hours

- Manufacturing overhead cost: $360,000

- Direct labor cost: $50,000

Finishing department:

- Direct labor hours: 30,000 hours

- Machine hours: 5,000 hours

- Manufacturing overhead cost: $486,000

- Direct labor cost: $270,000

The overhead rate of cutting department is based on machine hours and that of finishing department on direct labor cost.

Required: Work out predetermined overhead rate for each of the above two departments.

Solution

Cutting department:

Estimated manufacturing overhead cost/Estimated machine hours

= $360,000/48,000 hours

= $7.5 per machine hour

Finishing department:

Estimated manufacturing overhead cost/Estimated direct labor cost

= $486,000/$270,000

= $1.8 per dollar of direct labor

In finishing department, the company would apply $1.80 of manufacturing overhead for each dollar of direct labor cost incurred by the department. To state it another way, we can say that the manufacturing overhead would be applied @ 180% (= 1.80 x 100) of direct labor cost.

Leave a comment