Operating activities section by direct method

The operating activities section reports the cash flows that arise from the operating activities of a company during its reporting period. It is the first and perhaps the most complex section of the statement of cash flows. There are two commonly used methods for preparing the operating activities section – the direct method and the indirect method. This article explains the use of direct method. To learn about the indirect method, please read the article “operating activities section by indirect method“.

Contents:

- The direct method

- Format

- Cash received from customers

- Interest and dividend received

- Cash paid to suppliers and employees

- Interest paid

- Income tax paid

The direct method of preparing the operating activities section

Under the direct method, the major classes of operating cash receipts and disbursements are reported separately in the operating activities section. The total of operating cash disbursements is deducted from the total of operating cash receipts to arrive at net cash flows from operating activities. If the total of all operating cash receipts for the period is greater than the total of all operating cash disbursements, the resulting figure is known as the “net cash provided by operating activities”. If, on the other hand, the total of operating cash receipts is less than the total of operating cash disbursements, the resulting figure is known as the “net cash used by operating activities”.

The operating cash receipts or inflows generally include the following:

- cash received from customers,

- cash received for interest, and

- cash received for dividend income.

The operating cash disbursements or outflows generally include the following:

- cash paid to suppliers of merchandise (or raw materials),

- cash paid to employees,

- cash paid for operating expenses,

- cash paid for interest expenses, and

- cash paid for income tax.

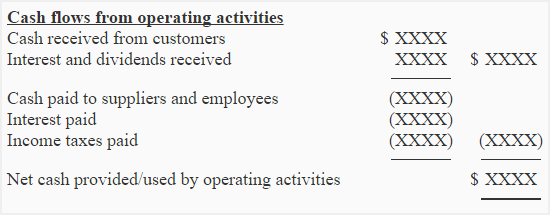

Format of operating activities section under direct method

Under the direct method, the operating cash receipts and disbursements described above are arranged in a certain way. A comprehensive format of the operating activities section under direct method is illustrated below:

In order to calculate the cash receipt and payment items shown in the above format, we use relevant data from the income statement, comparative balance sheet, and some additional information. Following is an explanation of how each receipt and payment item listed in the above format can be worked out.

Cash received from customers

If a company sells goods only for cash, then the amount of its sales revenue and cash received from customers will always be equal. In today’s business world, however, we can rarely find a company that sells all the goods for cash only. Most of the companies make sales in cash as well as on account. Therefore, the amount of sales revenue generated during a period mostly differs from the amount of cash received from customers during that period.

A company that sells goods on account can compute the cash received from its credit customers during a period by using three figures. These are the net sales, the beginning balance of accounts receivable, and the ending balance of accounts receivable. The procedure for this is explained below:

(i) If accounts receivable increase during the period

If accounts receivable at the end of the period are more than they are at the beginning of the period (i.e., an increase in the balance of the accounts receivable account occurs), then it means the company’s total credit sales are more than its collection from customers during the period. In this case, the increase in accounts receivable is deducted from the net sales figure to obtain the amount of cash received from customers during the period.

Cash received from customers = Net sales – Increase in accounts receivable

The net sales figure is available from the income statement, and the increase or decrease in accounts receivable can be determined using the beginning and ending balances of the accounts receivable.

(ii) If accounts receivable decrease during the period

If accounts receivable at the end of the period are less than they are at the beginning of the period (i.e., a decrease in the balance of the accounts receivable account occurs), then it means the company’s collection from customers is more than the credit sales. In this case, the decrease in accounts receivable is added to the net sales figure to obtain the amount of cash received from customers during the period.

Cash received from customers = Net sales + Decrease in accounts receivable

The above concept can be summarized as follows:

Example:

ABC Company sells goods on account. The income statement for the year 2023 shows net sales of $177,000. The accounts receivable at the beginning and at the end of the year are $25,000 and $35,000, respectively. Calculate the cash collected from customers by ABC during the year 2023.

Solution:

Cash received from customers = Net sales – Increase in accounts receivable

= $177,000 – $10,000*

= $167,000

*Increase in accounts receivable:

= $35,000 – $25,000

= $10,000

Interest and dividend received

The interest and dividend incomes earned from investments in other entities are reported in the income statement on an accrual basis. For the purpose of the statement of cash flows, we need to convert them from accrual basis to cash basis. For this purpose, we can use the same procedure and formula that we have used above to convert the accrual-based sales revenue to cash collected from customers. The accrual-based interest or dividend revenue figure is taken from the income statement and decreased by any increase in interest or dividend receivable during the year and increased by any decrease in interest or dividend receivable during the year. The formula can be modified as follows:

The amounts of interest and dividend received are added together and reported as a single line item in the statement of cash flows.

Example

The income statement of ABC Company for the year 2023 shows an interest income of $5,000 and a dividend income of $3,200. The balance in the interest receivable account at the beginning and end of 2023 is $1,000 and $1,200, respectively. The dividend income is received in cash, and there was no dividend receivable at the beginning or at the end of the year. Calculate the total amount of cash that ABC Company received during the year 2023 from interest and dividends.

Solution:

Cash received from interest and dividend = Interest revenue – Increase in interest receivable + Dividend revenue

= $5,000 – $200* + $3,200**

= $8,000

*Increase in interest receivable:

= $1,200 – $1,000

= $200

**There is no dividend receivable at the beginning and the end of the year. The dividend revenue is, therefore, equal to the cash received from the dividend.

Cash paid to suppliers and employees

The line item “cash paid to suppliers and employees” is the sum total of the cash paid to suppliers of inventory and the cash paid for operating expenses during the period. The cash paid to suppliers and the cash paid for operating expenses are calculated separately and then added together. The combined amount is reported as a single line item in the operating activities section with the caption “cash paid to suppliers and employees”.

Remember that payments made for interest and income tax are not included in the operating expenses; rather, they are reported as separate line items in the operating activities section.

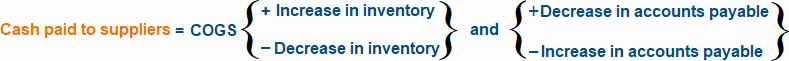

(i) Cash paid to suppliers of inventory

Companies purchase goods for cash as well as on account, so the amount of inventory purchased during a period does not necessarily represent the amount of cash paid to suppliers. A company that purchases inventory on account may purchase inventory in one period and pay the suppliers in another period. Therefore, for the purpose of the statement of cash flows, we need to work out the total amount of cash paid to suppliers of inventory during the period. The formula to calculate this figure is given below:

(ii) Cash paid for operating expenses

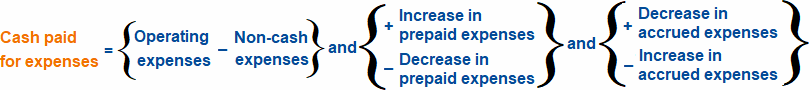

The operating expenses shown in the income statement do not necessarily represent the actual cash payments for those expenses during the period. The reason is that the expenses are reported in the income statement on an accrual basis rather than a cash basis. In other words, expenses are reported in the period in which benefit is taken from the use of goods and/or services rather than in the period in which the actual cash payment is made to the providers of such goods and/or services.

In order to convert accrual-based expenses to cash-based expenses, we need to consider two important points. First, the operating expenses that are reported in the income statement often include non-cash expenses such as depreciation, amortization, etc. Second, there is a difference in timing between the recognition of expenses and the payment of cash for them. The following procedure or formula is generally adopted to convert accrual-based operating expenses to cash paid for operating expenses:

Example:

ABC Company’s cost of goods sold (COGS) and operating expenses for the year 2023 is $65,000 and $15,000, respectively. The following balances have been taken from the company’s comparative balance sheet:

Accounts payable for the purchase of inventory:

- December 31, 2023: $15,000

- December 31, 2022: $20,000

Accrued expenses payable:

- December 31, 2023: $4,000

- December 31, 2022: $3,800

Prepaid expenses:

- December 31, 2023: $5,000

- December 31, 2022: $4,500

Closing inventory:

- December 31, 2023: $8,000

- December 31, 2022: $6,500

Required: Calculate the cash paid to suppliers of inventory and for expenses during the year 2023. How should the company disclose this payment on its statement of cash flows?

Solution:

(i). Cash paid to suppliers of inventory = Cost of goods sold + Increase in inventory + Decrease in accounts payable

= $65,000 + $1,500* + $5,000**

= $71,500

*Increase in inventory:

= (Inventory at Dec. 31, 2023) – (Inventory at Dec. 31, 2022)

= $8,000 – $6,500

= $1,500

**Decrease in accounts payable:

= (A/C P.A. at Dec. 31 2022) – (A/C P.A. at Dec. 31 2023)

= $20,000 – $15,000

= $5,000

(ii). Cash paid for operating expenses = Operating expenses + Increase in prepaid expenses – Increase in accrued expenses payable

= 15,000 + $500* – 200**

= $15,300

*Increase in prepaid expenses:

= (Prepaid expenses at Dec. 31, 2023) – (Prepaid expenses at Dec. 31, 2022)

= $5,000 – $4,500

= $500

**Increase in accrued expenses payable:

= (Acc. exp. P/A at Dec. 31, 2023) – (Acc. exp. P/A at Dec. 31, 2022)

= $4,000 – $3,800

= $200

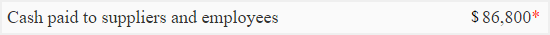

(iii). Disclosure in the statement of cash flows:

ABC Company will add the cash paid to suppliers to the cash paid for operating expenses and will report the total amount as a single line item in the operating activities section with the caption “cash paid to suppliers and employees”. The presentation of this item is illustrated below:

Cash paid for interest expense

The procedure or formula that we have used to convert accrual-based operating expenses to cash paid for operating expenses can also be used to convert accrual-based interest expenses to cash paid for interest. According to this procedure, a decrease in interest payable is added to and an increase in interest payable is deducted from the accrual-based interest expense. The accrual-based interest expense figure can be taken from the income statement, and the increase or decrease in interest payable liability can be obtained by analyzing the comparative balance sheet of the company.

Example:

The ABC Company’s total interest expenses for the year 2023 are $7,800. The interest payable at the end of the year 2023 and 2022 are as follows:

- Interest payable at December 31, 2023: $1,200

- Interest payable at December 31, 2022: $1,800

Required: Calculate cash paid for interest during 2023.

Solution:

Cash paid for interest = Interest expenses + Decrease in interest payable

= $7800 + $600*

= $8,400

*Decrease in interest payable:

= Interest payable on Dec. 31, 2022 – Interest payable on Dec. 31, 2023

= $1,800 – $1,200

= $600

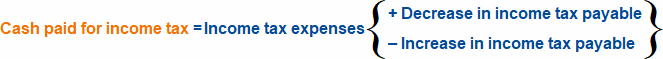

Cash paid for income tax expense

The cash payment for income tax during a period can be computed by following the same procedure as used above to determine the cash paid for interest and operating expenses. A decrease in income tax payable is added to and an increase in income tax payable is deducted from the income tax expense reported in the income statement. The procedure or formula for this is given below:

Example:

The income tax expense of ABC Company is $8,700 as per the income statement for the year 2023. The income tax payable liability at the end of the years 2023 and 2022 is as follows:

- December 31, 2023: $1,400

- December 31, 2022: $1,000

Required: Calculate the cash paid for income tax during 2023.

Solution:

Cash paid for income tax = income tax expenses – increase in income tax payable

= $8,700 – $400*

= $8,300

*Increase in income tax payable:

= Income tax payable on Dec. 31, 2023 – Income tax payable on Dec. 31, 2022

= $1,400 – $1,000

= $400

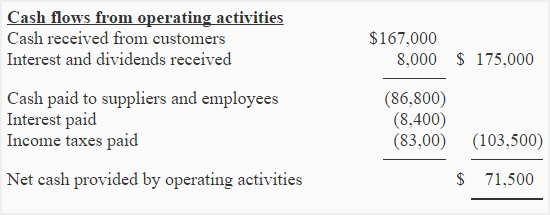

ABC Company’s operating cash receipts and disbursements during the year 2023 have been computed above. We can now list all the items together to prepare the operating activities section of the company’s statement of cash flows. The operating activities section under the direct method will look like the following:

Leave a comment