Measuring and recording direct labor cost

In job order costing system, the method of measuring and recording direct labor cost is similar to measuring and recording direct materials cost.

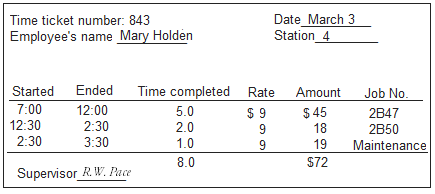

Direct labor hours worked, direct labor rate per hour, and total amount in dollars for each individual job or task is recorded on a document known as time ticket or employee time ticket. A separate time ticket is prepared by each worker for every working day.

Accounting department collects all time tickets at the end of the day. These time tickets are used to enter direct labor cost on the job cost sheet of each individual job order. An example/sample of complete time ticket is given below:

Employee Time Ticket

In job order costing system, any labor charges that are not directly traceable to a particular job are known as indirect labor cost. In example of time ticket given above “maintenance” is indirect labor. Other examples of indirect labor are cleanup costs and supervision etc. Indirect labor is not included in direct labor cost and, therefore, becomes a part of the manufacturing overhead.

These days, many companies have replaced the manual process of recording direct materials cost with the computerized approaches. They use a bar code technology to enter data into a computer. This technology increases the speed and accuracy of the whole process.

Journal entry to record direct labor cost:

After collecting time tickets by accounting department, wages of workers are computed and labor costs are classified as direct or indirect on the basis of information provided by time tickets. As discussed earlier, indirect labor is a part of manufacturing overhead and its accounting treatment has been discussed in “measuring and recording manufacturing overhead” article. The journal entry of direct labor cost is made as follows:

Leave a comment