LIFO reserve

Definition and explanation

Most of the companies use first-in, first-out (FIFO), average, or standard cost method for internal uses and last-in, first-out (LIFO) method for external reporting and tax purposes. The LIFO reserve (also known as the allowance to reduce inventory to LIFO) is an account that represents the difference between the inventory cost computed for internal reporting purpose using a non-LIFO method and the inventory cost computed using LIFO method. For example, the LIFO reserve of a company that uses FIFO for internal reporting and LIFO for external reporting can be expressed in the form of the following equation:

LIFO reserve = FIFO inventory – LIFO inventory

The above equation assumes that the FIFO inventory is higher than the LIFO inventory, that is usually found in an inflationary environment. In a deflationary environment, the LIFO inventory would be higher than the FIFO inventory and the LIFO reserve could be expressed as follows:

LIFO reserve = LIFO inventory – FIFO inventory

LIFO effect:

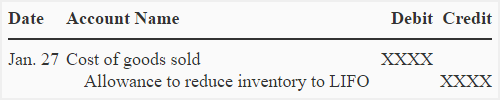

The change in the balance of LIFO reserve account during the year is referred to as LIFO effect. The following entry is made at the end of the year to record this change:

A company using a non-LIFO method would deduct the LIFO reserve (allowance to reduce inventory to LIFO) from the inventory if it needs to state the inventory on LIFO basis.

Consider the following example for more explanation:

Example:

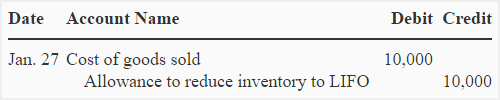

The Fine company uses FIFO method for internal reporting and LIFO method for external reporting. The inventory on December 31, 2021 is $180,000 under FIFO and $130,000 under LIFO. The LIFO reserve (or allowance to reduce inventory to LIFO) account showed a credit balance of $30,000 on January 1, 2021.

Required: What is the amount of LIFO reserve and LIFO effect? Prepare a journal entry to adjust the LIFO reserve at the end of the year.

Solution:

1. LIFO reserve:

LIFO reserve = FIFO inventory – LIFO inventory

= $180,000 – $130,000

= $50,000

2. LIFO effect:

LIFO effect = LIFO reserve – Beginning balance

= $50,000 – $30,000

= $20,000

3. Journal entry at the end of the year:

The use of LIFO reserve in ratios analysis:

Ratios analysis is a useful tool to evaluate and compare the liquidity, profitability, and solvency of companies. Most of the ratios of two companies can be compared only if they use the same inventory valuation method.

Current ratio is a widely used metric to analyze and compare the liquidity of companies. For example, if company A uses LIFO method but company B uses FIFO method, the current ratio of the two companies would not be comparable. However, if LIFO reserve of company A is known, it can be added to LIFO inventory to convert it to the FIFO inventory. The FIFO inventory of company A would then be comparable to the FIFO inventory of company B.

FIFO inventory of company A = LIFO inventory of company A + LIFO reserve of company A

To compute the FIFO amount of cost of goods sold of company A, the change in the LIFO reserve account during the period (LIFO effect) would be subtracted from the LIFO amount of the cost of goods sold of company A.

FIFO COGS of company A = LIFO COGS of company A – change in LIFO reserve during the period

Leave a comment