LIFO periodic vs LIFO perpetual inventory system

The LIFO periodic system and the LIFO perpetual system may generate different cost of goods sold (or materials issued) and the cost of ending inventory figures. The reason is that under LIFO periodic system, the total of sales (or issues) is matched with the total of purchases (including beginning inventory, if any) at the end of the period whereas under LIFO perpetual system, each sale (or issue) is matched with the immediate preceding purchases.

For better understanding of the concept, we need an example.

Example – LIFO periodic vs LIFO perpetual:

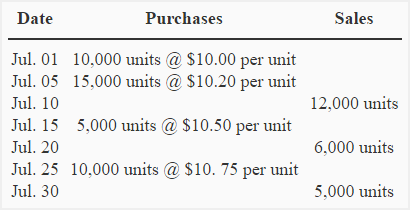

The Fine Dealings Inc. has the following transactions for the first month of operations:

The Fine Dealings Inc. uses last-in, first out (LIFO) method for inventory valuation purposes. There was no inventory in hand at the beginning of the month of July.

Required: Compute the cost of goods sold during the month and inventory in hand at the end of the month under:

- LIFO periodic system.

- LIFO perpetual system.

Solution:

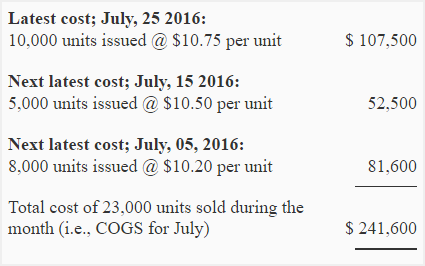

(1). LIFO periodic

a. Cost of goods sold:

Number of units sold during the month: 12,000 units + 6,000 units + 5,000 units = 23,000 units

Under periodic LIFO, the cost of above 23,000 units have been computed below:

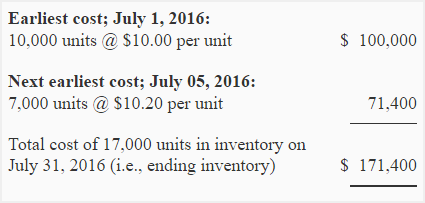

b. Cost of ending inventory:

Ending inventory = Beginning inventory + Number of units purchased during the month – Number of units sold during the month

= 0 units + *40,000 units – **23,000 units

= 17,000 units

* Units purchased during the month: 10,000 units + 15,000 units + 5,000 units + 10,000 units = 40,000 units

** Units sold during the month: 12,000 units + 6,000 units + 5,000 units = 23,000 units

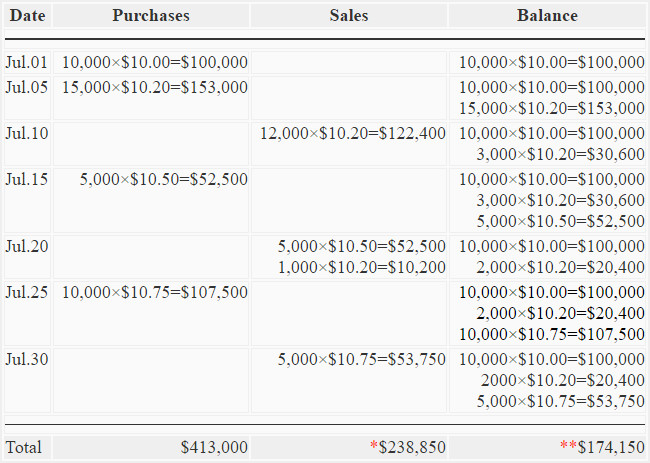

(2). LIFO perpetual

Cost of goods sold and ending inventory:

*Cost of goods sold (total of sales column)

**Cost of ending inventory (the last row of balance column)

Notice that the cost of goods sold and ending inventory amounts computed under LIFO periodic are different from the cost of goods sold and ending inventory amounts computed under LIFO perpetual. The reason is that the LIFO periodic system does not take into account the exact dates involved but LIFO perpetual does. In above example, LIFO periodic system assumes that all the units purchased on July 30 have been sold and ending inventory is to be valued using earliest costs. But if computations are made on the basis of LIFO perpetual system, out of 10,000 units purchased on July 30, 5000 units remain unsold and go to ending inventory at the same cost at which they were purchased.

Leave a comment