Issuing stock for services rendered

Companies frequently avail services of outside individuals, firms and companies. The cost of such services may be paid in the form of shares of the company’s stock.

As no cash outflow is involved, this method of payment is appealing especially to newly incorporated and cash poor companies. The major problem involved in such transactions is the determination of value.

A general rule of recording the issuance of stock for services is similar to the rule of issuing stock for non-cash assets. It is recorded on the basis of fair market value of services availed or the fair market value of shares issued, whichever can be objectively determined.

For a better understanding of the valuation and recording such stock related transactions, consider the following example:

Example:

On December 31, 2021, Western Company hired HK firm to avail some legal services. HK firm agreed to receive 500 shares of its client company’s stock as consideration of legal services provided. The par value per share was $5.

Required: Make journal entries to record above transaction in each of the following cases:

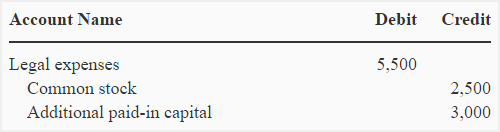

- The fair market value of stock is $5,500 but fair market value of legal services is not known.

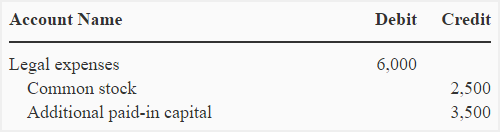

- The fair market value of legal services is $6,000 but fair market value of shares issued is not known.

Solution:

(1). When the fair market value of stock issued is known:

(2). When the fair market value of legal services availed is known:

Leave a comment