Issuing stock for non-cash assets

Companies need long term fixed assets (land, building, machinery, equipment and vehicles etc.) to carry out various business activities. One way to acquire these assets is to purchase them for cash from open market and another way is to acquire them in exchange of company’s stock.

Issuing stock for non-cash tangible and intangible assets is very common. Also, it is very convenient approach for newly established and small companies that need funds and try to minimize their cash outflows. However, the valuation often becomes a major problem for recording such non-cash transactions. The general rule is to record these transactions on the basis of fair market value of the non-cash asset acquired or the fair market value of the stock issued, whichever can be more clearly and reliably determined.

If the fair market value of the asset to be received from the vendor or the stock to be issued to him or her is not readily determinable, the board of directors or management can determine a value that is fair in their opinion. If necessary, they can also seek the assistance of a qualified independent valuer for this purpose.

Students should keep in mind that the value determined for either of the two would be applicable to both. For example, if a stock’s fair market value has been objectively determined and is to be considered for accounting purpose, the same value would be treated as the fair market value of the non-cash asset being acquired. Let’s take an example to further clarify the concept.

Example

Northern Company purchased a piece of land to build a new factory on it. The company will issue 20,000 shares of its $10 par value common stock to the vendor of land as consideration. Make journal entries in each of the following situations:

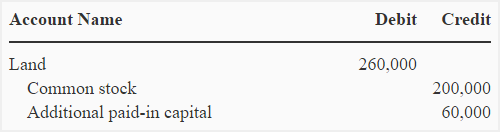

- The fair value of stock is $260,000 and the fair market value of land cannot be reliably determined.

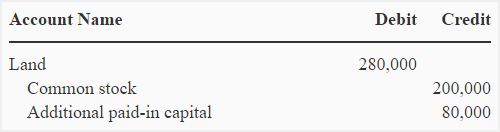

- The fair market value of land is $280,000 and the fair market value of the stock cannot be reliably determined.

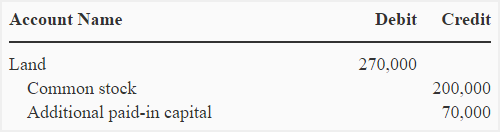

- The board of directors seeks the help of a professional valuer who values the land at $270,000.

- A valuer determines the market value of land equal to 100 percent of par value of of shares offered.

Solution:

(1). When the fair market value of stock is readily determinable:

(2). When the fair market value of land is readily determinable:

(3). When the land is valued by an independent professional:

(4). When the value of land is determined to be equal to 100% of par value of 20,000 shares:

Notice that in all four cases of stock issue, the common stock account has been credited with its par value. Students should remember that whenever we record an entry for the issuance of common or preferred stock, we always credit the stock with its par value.

Companies may also use their treasury stock to acquire non-cash assets that they need to conduct their operations. If shares from treasury stock are used, the fair value of those shares or the fair value of non-cash asset acquired should be used for valuation. The cost of treasury stock should not be used for this purpose.

Impact on statement of cash flows

The issuance of stock for a non-cash item is essentially a non-cash financing activity that should be disclosed at the bottom of the statement of cash flows or in a separate note to the statement. To learn more about such disclosure, read non-cash investing and financing activities article.

Leave a comment