First-in, first-out (FIFO) method in perpetual inventory system

The first-in, first-out (FIFO) method is a widely used inventory valuation method that assumes that the goods are sold (by merchandising companies) or materials are issued to production department (by manufacturing companies) in the order in which they are purchased. In other words, the costs to acquire merchandise or materials are charged against revenues in the order in which they are incurred.

Under first-in, first-out method, the ending balance of inventory represents the most recent costs incurred to purchase merchandise or materials.

The use of FIFO method is very common to compute cost of goods sold and the ending balance of inventory under both perpetual and periodic inventory systems. The example given below explains the use of FIFO method in a perpetual inventory system. If you want to understand its use in a periodic inventory system, read “first-in, first-out (FIFO) method in periodic inventory system” article.

Example:

Fine Electronics Company uses perpetual inventory system to account for acquisition and sale of inventory and first-in, first-out (FIFO) method to compute cost of goods sold and for the valuation of ending inventory. The company has made the following purchases and sales during the month of January 2023.

- Jan. 01: Inventory at the beginning of the month; 24 units @ $1,000 per unit.

- Jan. 04: Sales: 16 units.

- Jan. 07: Purchases; 12 units @ $1,020 per unit.

- Jan. 10: Purchases; 10 units @ $1,050 per unit.

- Jan. 14: Sales; 16 units.

- Jan. 23: Sales; 12 units.

- Jan. 24: Purchases; 12 units @ $1,060 per unit.

- Jan. 27: Purchases; 4 units @ $1,080 per unit.

- Jan. 29: Sales; 6 units.

During the month, all sales have been made @ $1600 per unit.

Required:

- Prepare journal entries to record the above transactions under perpetual inventory system.

- Prepare a FIFO perpetual inventory card.

- Compute the cost of goods sold and the cost of inventory in hand at the end of the month of January 2023.

Solution:

(1). Journal entries:

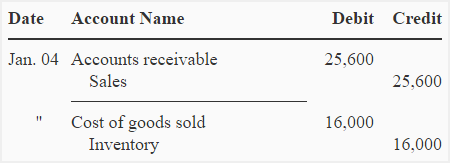

January 4:

Fine Electronics Company has sold 16 units for $25,600 (16 units × $1,600) on January 4, 2023. On this date, 24 units in the beginning inventory are the only units available for sale and the cost of these units is $16,000 (16 × $1,000). Since the company uses a perpetual inventory system, two journal entries would be made for the sale of inventory – one to reduce the balance of inventory account by the cost of 16 units and one to record the sale of 16 units. These two journal entries are given below:

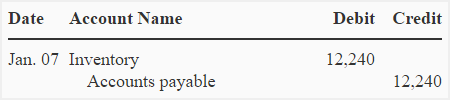

January 7:

The following entry would be made to record the purchase of 12 units @ $1,020 per unit on January 7:

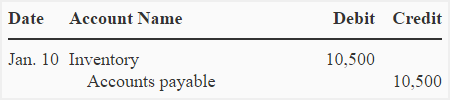

January 10:

The following entry would be made to record the purchase of 10 units @ $1,060 per unit on January 10:

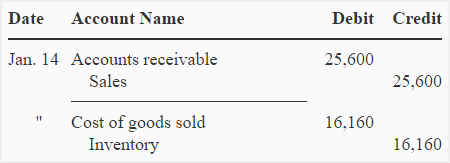

January 14:

According to FIFO assumption, first costs incurred are first costs expensed, the cost of 16 units sold on 14 January would, therefore, be computed as follows:

Cost of 8 units (from beginning inventory):

8 units × $1,000 = $8,000

Cost of 8 units (from units purchased on January 7):

8 units × $1,020 = $8,160

Total cost of 16 units sold on January 14:

$8,000 + $8,160 = $16,160

The journal entries for the above sales would be made as follows:

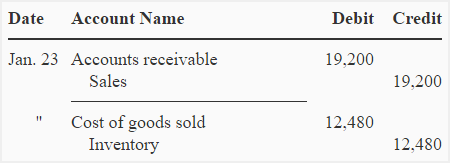

January 23:

According to first-in, first-out (FIFO) method, the cost of 12 units sold on 23 January is computed below:

Cost of 4 units (from units purchased on January 7):

4 units × $1,020 = $4,080

Cost of 8 units (from units purchased on January 10):

8 units × $1,050 = $8,400

Total cost of 12 units sold on 23 January:

$4,080 + $8,400 = $12,480

The journal entries for the above sales would be made as follows:

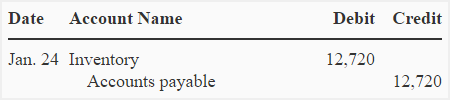

January 24:

On January 24, the following entry would be made to record the purchase of 12 units @ $1,060 per unit.

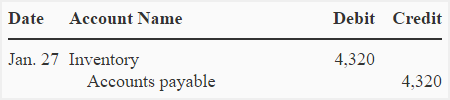

January 27:

On January 27, the following entry would be made to record the purchase of 4 units @ $1,080 per unit.

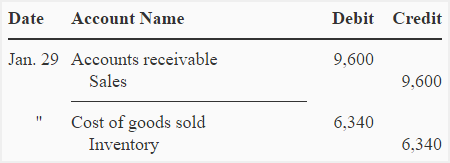

January 29:

According to first-in, first-out (FIFO) method, the cost of 6 units sold on 29 January is computed below:

Cost of 2 units (from units purchased on January 10):

2 units × $1,050 = $2,100

Cost of 4 units (from units purchased on January 29):

4 units × $1,060 = $4,240

Total cost of 6 units sold on 29 January:

$2,100 + $4,240 = $6,340

The journal entries for these sales would be made as follows:

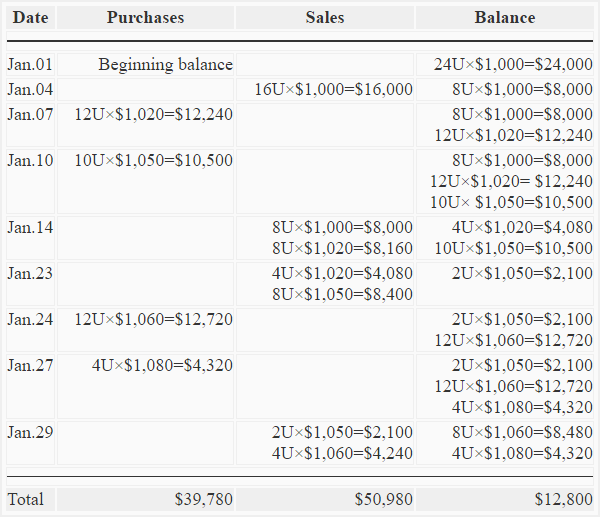

(2). FIFO perpetual inventory card:

Companies using perpetual inventory system prepare an inventory card to continuously track the quantity and dollar amount of inventory purchased, sold and in stock. This card is known as perpetual inventory card. A separate perpetual inventory card is prepared for each inventory item. This card has separate columns to record purchases, sales and balance of inventory in both units and dollars. The quantity and dollar information in these columns are updated in real time i.e., after each purchase and each sale. At any point in time, the perpetual inventory card can, therefore, provide information about purchases, cost of sales and the balance in inventory to date.

The perpetual inventory card of Fine Electronics Company is prepared below using FIFO method:

(3). Cost of goods sold (COGS) and ending inventory:

With the help of above inventory card, we can easily compute the cost of goods sold and ending inventory.

- *Cost of goods sold:

$16,000 + $8,000 + $8,160 + $4,080 + $8,400 + $2,100 + $4,240 = $50,980 - **Ending inventory:

$8,480 + $4,320 = $12,800

* The total of sales column of perpetual inventory card.

** The balance at 29 January – at the end of balance column.

Leave a comment