Factoring accounts receivable

Definition and explanation:

Factoring accounts receivable means selling receivables (both accounts receivable and notes receivable) to a financial institution at a discount. Factoring is a common practice among small companies. The institution to whom receivables are sold is known as factor.

Someone might think, why do companies sell their receivables? The answer is simple – to meet their immediate cash needs. Rather than waiting for the due date, a company may quickly convert its receivables into cash by selling them to a factor for a fee, which is usually a small percentage of the total value of receivables being factored. As the due date approaches, factor meets receivables and collects full amount of cash. The difference between the cash collected from receivables and the cash paid to the seller company forms the profit of the factor.

In a factoring transaction, the receivables are evaluated regarding their recoverability and a fee is agreed upon between the factor and the seller. The factor then takes over receivables along with all relevant records and pays the cash to the seller after deducting the agreed fee. In addition to this fee, the factor may also retain a small percentage of receivables for probable events like adjustments for discounts, returns and allowances. The amount deducted in respect of such adjustments is usually refundable to the seller in case no event requiring such deductions arises.

Factoring receivables with or without recourse

Accounts receivable are factored either without recourse or with recourse. These two conditions are breifly discussed below.

Factoring without recourse:

When accounts receivable are factored without recourse, the factor (purchasing institution) bears the loss resulting from bad debts. For example, if a receivable whose account has been factored becomes bankrupt and the amount due from him cannot be collected, the factor will have to bear the loss.

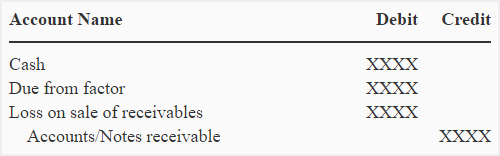

Journal entries:

Under non-recourse factoring the seller makes the following journal entry:

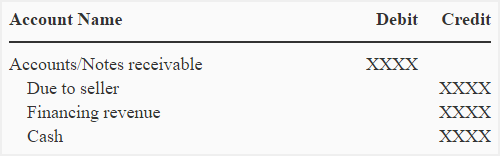

The buying institution records the following journal entry:

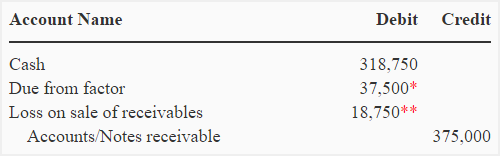

Example 1:

To meet its short-term cash needs, the Noor company factors $375,000 of accounts receivable with Moto Finance on a without recourse basis. The Moto Finance assesses the quality of accounts receivable and charges a fee of 5%. It also retains an amount equal to 10% of the accounts receivable for probable adjustments against discounts, returns and allowances etc.

Required: Make journal entries in the books of Noor company and Moto Finance to record the above information.

Solution:

(1). Journal entries in the books of Noor company:

*375,000 × 0.1

**375,000 × .05

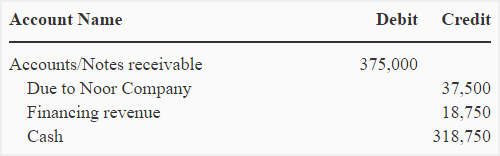

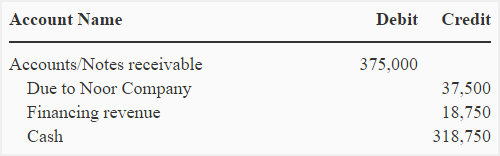

(2). Journal entries in the books of Moto Finance:

Factoring with recourse:

In a factoring with recourse transaction, the seller guarantees the collection of accounts receivable i.e., if a receivable fails to pay to the factor, the seller will pay. As the recovery is guaranteed by the seller, a recourse liability is determined and recorded by him. The loss on sale of receivable is also increased by the amount of recourse liability.

Example 2:

Use the information from example 1 and suppose that the factoring is with recourse. If Noor company estimates that the fair value of the recourse liability is $750, the journal entries to be recorded by both the companies are given below:

(1). Journal entries in the books of Noor company:

**($375,000 × .05) + ($750)

(2). Journal entries in the books of Moto Finance:

very Beneficial and very effective