Financial leverage

Financial leverage (or only leverage) means acquiring assets with the funds provided by creditors and preferred stockholders for the benefit of common stockholders. Financial leverage is a two-edged sword. It may be positive or negative. The following paragraphs explain what is positive and what is negative financial leverage.

Positive financial leverage:

A positive financial leverage means that the assets acquired with the funds provided by creditors and preferred stockholders generate a rate of return that is higher than the rate of interest or dividend payable to the providers of funds. Positive financial leverage is beneficial for common stockholders. For example, XYZ company obtains a long term debt at a rate of 12%. The company can use the funds to earn an after-tax rate of 14%. The interest on debt is tax deductible. If the tax rate is 40%, the after-tax interest rate would be 7.2% [12% × (1 – 0.4)]. The difference of 6.8% (14% – 7.2%) is, therefore, the benefit of common stockholders.

In this situation, the financial leverage is positive because the after-tax rate of return is higher than the after-tax rate of interest on long-term debts.

Negative financial leverage:

A negative financial leverage occurs when the assets acquired with the debts and preferred stock generate a rate of return that is less than the rate of interest or dividend payable to the providers of debts or preferred stock. Negative financial leverage is a loss for common stockholders.

Impact of income tax on financial leverage:

Debt is considered a more effective source of positive financial leverage than preferred stock because the interest on debt is tax deductible but dividend on preferred stock is not. For explanation of this point, consider the following example.

Example:

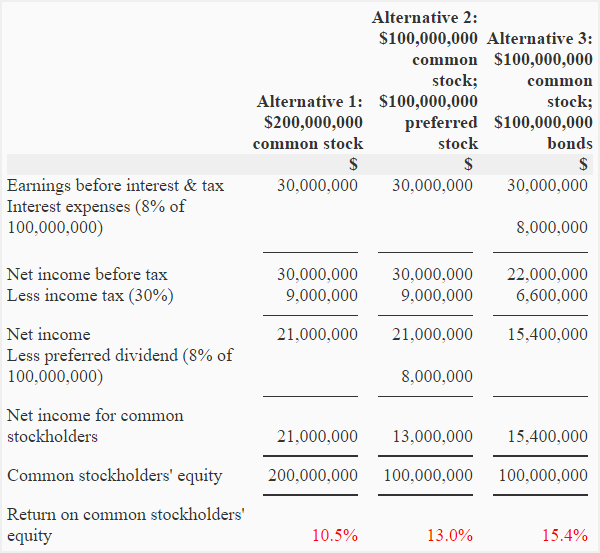

Suppose a company is considering to expand its production plants. This expansion requires a financing of $200 million and is expected to increase the net income before interest and tax by $30 million. The three proposed ways of raising finance for this purpose are as follows:

- By issuing common stock.

- By issuing common stock and 8% preferred stock in the ratio of 1 : 1.

- By issuing common stock and 8% bonds in the ratio of 1 : 1.

The following computations show how obtaining debt can be a more efficient way of generating positive financial leverage than issuing preferred stock.

The alternatives in above example generate different return on common stockholders’ equity. The reason of this difference is explained below:

Alternative-1:

The first alternative generates 10.5% return on common stockholders’ equity, there is no debt or preferred stock involved, the leverage is therefore zero in this case.

Alternative-2:

The second alternative generates 13% return on common stockholders’ equity, the preferred stock is present but there is no debt.

Alternative-3:

The third alternative generates 15.4% return on common stockholders’ equity which is the highest among three alternatives. The reason is that the preferred stock in this case is replaced with the debt. The interest on debt is a tax deductible expense while the dividend on preferred stock is not.

Leave a comment