Exercise-5 (Working backward from materials and labor variances)

ABC company manufactures and sells product X. The standards for materials and labor costs to manufacture one unit of product X are as follows:

- Direct materials: 6lbs. @ $2 per lb.

- Direct labor: 1 hour @ $8 per hour

ABC company purchased 26,000 pounds of direct materials for $27,300 and manufactured 4,000 units of product X during January 2012.

The following variances data belong to the January 2012:

- Materials price variance: $2,600 Unfavorable

- Materials quantity variance: $2,000 Unfavorable

- Direct labor rate variance: $1,520 Unfavorable

- Direct labor efficiency variance: $1,600 Favorable

Required:

- Compute standard quantity of direct materials allowed (in pounds) for January production.

- Compute the actual quantity of materials used (in pounds) for January production.

- Compute the standard direct labor hours allowed for January production.

- Compute actual direct labor hours worked for January production.

- Compute actual direct labor rate.

Solution:

(1) Standard quantity of direct materials allowed for January production:

Standard quantity of materials allowed = Actual production for January × Standard materials per unit

= 4,000 units × 6 lbs.

= 24,000 lbs.

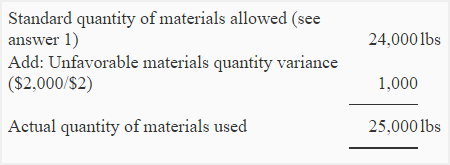

(2) Actual quantity of direct materials used for January production:

(3) Standard direct labor hours allowed for January production:

Standard hours allowed for January production = Actual production for January × Standard hours per unit

= 4,000 units × 1 hours

= 4,000 hours

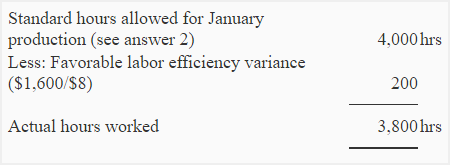

(4) Actual direct labor hours worked for January production :

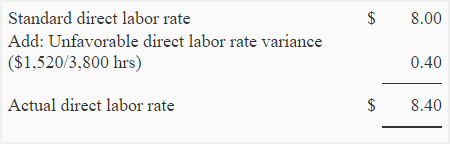

(5) Actual direct labor rate:

Leave a comment