Exercise-5 (CM ratio, break-even analysis, target profit analysis, margin of safety)

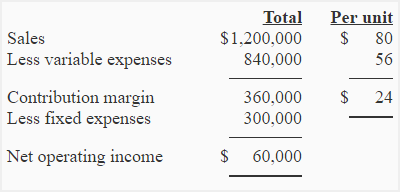

Following is the contribution margin income statement of a single product company:

Required:

- Calculate break-even point in units and dollars.

- What is the contribution margin at break-even point?

- Compute the number of units to be sold to earn a profit of $36,000.

- Compute the margin of safety using original data.

- Compute CM ratio. Compute the expected increase in monthly net operating if sales increase by $160,000 and fixed expenses do not change.

Solution:

(1) Break-even point in units and dollars:

Fixed expenses/Unit contribution margin

$300,000/$24

12,500 units

or

(12,500 units × $80) = $1,000,000

(2) Contribution margin at break-even point:

Contribution margin must be $300,000 at break-even point because it will cover fixed costs and nothing will remain to go towards profit.

(3) Computation of target profit:

(Fixed expenses + Target profit)/Unit contribution margin

($300,000 + $36,000)/$24

Company must sell 14,000 units of product to earn a target profit of $36,000.

(4) Margin of safety in dollars and percentage:

Margin of safety in dollars = Actual or budgeted sales – sales required to break-even

$1,200,000 – $1,000,000

$200,000

or

Margin of safety in percentage = Margin of safety in dollars/Actual or budgeted sales

= $200,000/$1,200,000

=0.1667 or 16.67%

(5) CM ratio and expected change in net operating income:

Contribution margin/Total sales

= $360,000/$1,200,000

= 0.30 or 30%

If the sales are increased by $160,000 without any change in fixed expenses, the net operating income will be increased by $48,000 as computed below:

$160,000 × CM ratio

$160,000 × 0.3

= $48,000

BEP( units) = FC/ contribution margin per units

300000/24= 12500 units.

BEP ( value) = FC/ CMR

CMR=sales- vc/ sales.

1200000-840000/1200000=0.3

300000/0.3=$1000000.