Exercise-16: Net present value (NPV) analysis of two alternatives

Learning objective:

This exercise illustrates a simple NPV comparison of two alternatives with equal project lives.

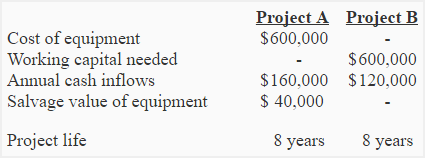

Sunshine Company is considering two projects – project A and project B. Project A requires the purchase of a new piece of equipment but no working capital investment whereas project B requires a working capital investment but no equipment. The relevant information to conduct a net present value analysis (NPV) is given below:

The working capital required for project B will be released at the end of eight years life of the project. Sunshine Company uses an 18% discount rate for analyzing investment in capital assets.

Required: Are the two projects mentioned above comparable on the basis of their net present values? If yes, select the best one to invest using net present value (NPV) method. (Ignore income tax).

Solution:

The two or more projects are comparable on the basis of net present values when they require equal amount of investment. Since, the project A and project B both require the same initial investment of $600,000, they can be compared using NPV method.

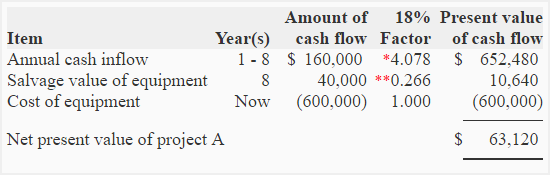

NPV of project A:

*Value from “present value of an annuity of $1 in arrears table“.

**Value from “present value of $1 table“.

NPV of project B:

*Value from “present value of an annuity of $1 in arrears table“.

**Value from “present value of $1 table“.

Conclusion:

According to NPV analysis, project A looks more attractive because the net present value of its cash flows is higher than project B.

Alternatively, the profitability indexes of both project A and project B can be computed for comparison.

Profitability index = Present value of cash inflows/Investment required

- Project A: ($652,480 + $10,640)/$600,000 = 1.105

- Project B: ($489,360 + $159,600)/$600,000 = 1.082

Project A’s profitability index is higher than project B. Project A is therefore a preferred investment.

Leave a comment