Exercise-13: Preparation of statement of cash flows – Indirect method

Learning objectives:

This exercise illustrates the preparation of the statement of cash flows under the indirect method when the income statement and comparative balance sheet are given.

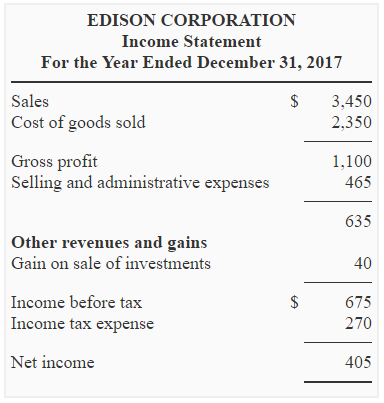

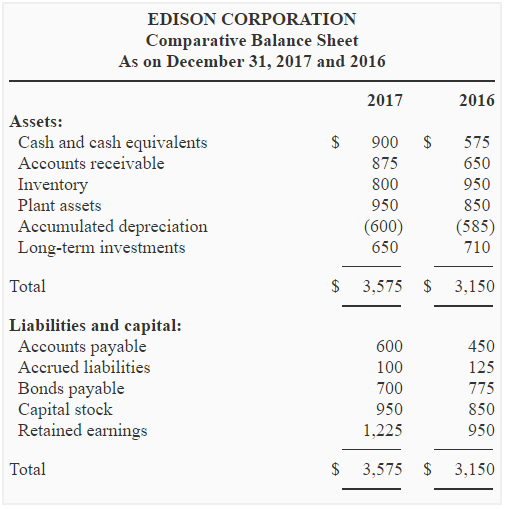

The income statement and comparative balance sheet of Edison Corporation are given below:

During the year 2017, a dividend of $130 was declared and paid by the management of Edison Corporation. Some plant assets were purchased in 2017, and the payment was settled by issuing common stock amounting to $35.

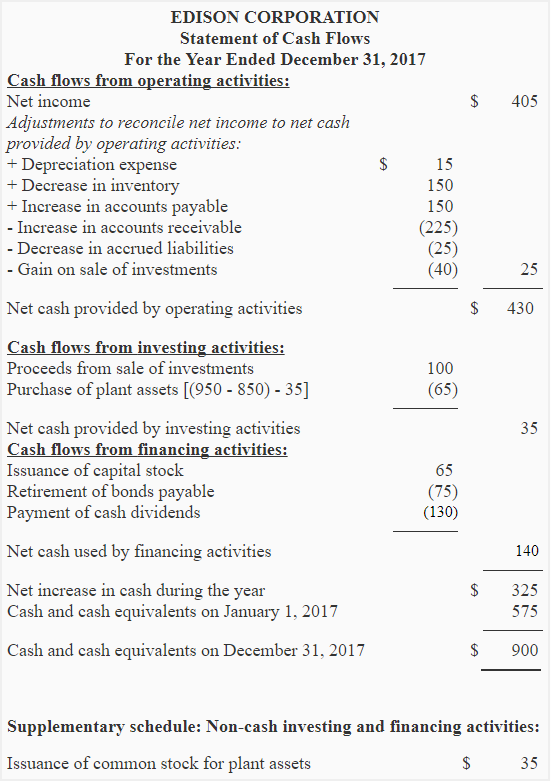

Required: Using the data given above, prepare a statement of cash flows for Edison Corporation using the indirect method.

Solution

Computation of figures used in the above statement:

Depreciation expense for the year 2017:

Accumulated depreciation on December 31, 2017 – Accumulated depreciation on December 31, 2016

= $600 – $585

= $15

Issuance of capital stock for cash:

(Capital stock on Dec. 31, 2017 – Capital stock on Dec. 31, 2016) – Capital stock issued in exchange of plant assets

= ($950 – $850) – $35

= $65

Cash received from sale of investment:

Cost of investment sold + Gain on sale of investment

= ($710 – $650) + $40

= $60 + $40

= $100

Cash paid for purchase of plant assets:

(Gross plant assets on Dec. 31, 2017 – Gross plant assets on Dec. 31, 2016) – Plant assets acquired in exchange of common stock

= ($950 – $850) – $35

= $65

Hi, nice resource, thanks for it, how do you calculate payment of dividends please?

Fair enough