Exercise-13: Accounting rate of return (ARR) with uneven cash flows

Learning objective:

This exercise illustrates the computation of accounting rate of return (ARR) when a projects cash flows are uneven.

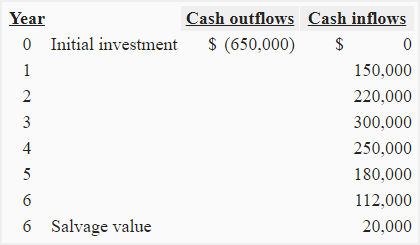

A project requiring an initial cost of $650,000 is expected to generate the following cash flows over its 6-years life:

The project does not require any cash expenses. Depreciation is to be provided using a general straight line method. According to firm’s accounting policies, the salvage value is treated as the reduction in depreciable basis.

Required: Compute the project’s accounting rate of return (ARR) from above information.

Solution:

Step 1 – Computation of annual depreciation expenses:

(Cost – salvage value)/life of the asset

= ($650,000 – $20,000)/6

= $10,5000

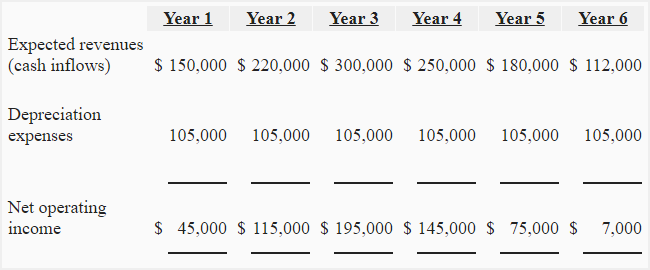

Step 2 – Computation of average incremental annual income:

Average income = (45,000 + 115,000 + 195,000 + 145,000 + 75,000 + 7,000)/6

= $97,000

Step 3 – Computation of accounting rate of return (ARR):

If initial investment is used as denominator:

Accounting rate of return = Incremental accounting income/Initial investment

= $97,000/$650,000

= 14.92%

If average investment is used as denominator:

Accounting rate of return = Incremental accounting income/Average investment

= $97,000/$335,000*

= 28.96%

*Average investment in project:

($650,000 + $20,000)/2

= $335,000

Leave a comment