Allowance for doubtful accounts by aging method

Normally, two methods are used for estimating allowance for doubtful accounts – aging method and sales method. On this page, we shall explain how companies use aging method for calculating their allowance for doubtful accounts. Click here if you want to read about the use of sales method.

Explanation of aging method

The aging method (also referred to as balance sheet approach) classifies accounts receivable into different age groups. According to this approach, the longer the period for which an account receivable remains outstanding, the lesser are the chances of its collection. The classification of accounts receivable into various age groups is typically known as aging of accounts receivable.

Under aging method of estimating allowance for doubtful accounts, a percentage of accounts receivable in each age group is considered to be uncollectible. This percentage is usually different for each age group and is estimated on the basis of past experience and current economic conditions of the areas where company conducts its operations. The estimated uncollectible percentage of each age group is applied to the total dollar amount of accounts receivable in that group to obtain an estimated uncollectible amount of the group. The estimated uncollectible amounts for all age groups are separately calculated and added together to find the total or overall estimated uncollectible amount. This total or overall estimated uncollectible amount represents the required balance in allowance for doubtful accounts account at the end of the period.

The aging method explained above is popular among companies where most of the goods are sold on credit. The following example will hopefully make the whole procedure more understandable.

Example:

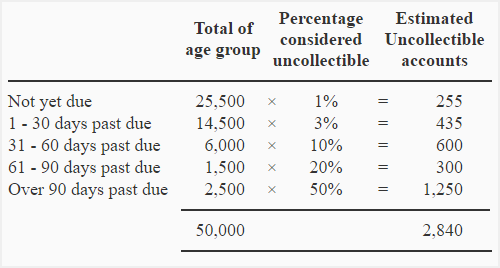

The Fast company has divided its accounts receivable into five age groups by preparing the following aging schedule:

On the basis of past experience and current economic conditions, the company has determined the percentage of expected credit losses in each age group as follows:

- Not yet due: 1%

- 1 – 30 days past due: 3%

- 31 – 60 days past due: 10%

- 61 – 90 days past due: 20%

- Over 90 days past due: 50%

At the end of the year 2022, the allowance for doubtful accounts account shows a credit balance of $2,000.

Required:

- Compute the total amount of estimated uncollectibles (the required balance in the allowance for doubtful accounts account) on the basis of above information.

- Prepare an adjusting entry to recognize uncollectible accounts expense and adjust the balance in allowance for doubtful accounts account to the required amount.

Solution:

(1). Computation of required balance in the allowance for doubtful accounts account:

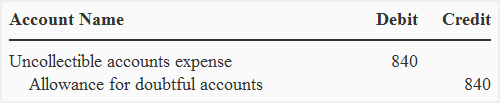

(2). Adjusting entry at the end of the period:

According to above calculations, the total estimated uncollectible amount at the end of the year is $2,840 which represents the required balance in allowance for doubtful accounts account at the end of the period. Since the company already has a credit balance of $2,000 in its allowance for doubtful accounts account, the year-end adjusting entry will be made for the amount of only $840 ($2,840 – $2,000).

The adjusting entry needed for this purpose at the end of 2022 is given below:

With this entry, the balance in allowance for doubtful accounts account will increase form $2,000 to required balance of $2,840.

Leave a comment