Adjusting entries

Contents:

- Definition and explanation

- The purpose of adjusting entries

- When adjusting entries are made?

- Types and and examples

Definition and explanation:

Adjusting entries (also known as end-of-period adjustments) are journal entries that are made at the end of an accounting period to adjust the accounts to accurately reflect the revenues and expenses of the current period.

The preparation of adjusting entries is the fifth step of the accounting cycle that starts after the preparation of the unadjusted trial balance.

Companies that prepare their financial statements in accordance with United States Generally Accepted Accounting Principles (US-GAAP) and International Financial Reporting Standards (IFRS) usually prepare some adjusting entries at the end of each accounting period.

In this article, we shall first discuss the purpose of adjusting entries and then explain the method of their preparation with the help of some examples.

The purpose of adjusting entries:

According to the accrual concept of accounting, revenue is recognized in the period in which it is earned, and expenses are recognized in the period in which they are incurred. Some business transactions affect the revenues and expenses of more than one accounting period. For example, a service providing company may receive service fees from its clients for more than one period, or it may pay some of its expenses for many periods in advance. All revenues received or all expenses paid in advance cannot be reported on the income statement for the current accounting period. They must be assigned to the relevant accounting periods and must be reported on the relevant income statements.

The purpose of adjusting entries is to assign an appropriate portion of revenue and expenses to the appropriate accounting period. By making adjusting entries, a portion of revenue is assigned to the accounting period in which it is earned, and a portion of expenses is assigned to the accounting period in which it is incurred. It ensures that only the relevant revenue and expenses are reported in the income statement of a particular accounting period, and the financial statements have been prepared correctly in accordance with the accrual concept of accounting.

When adjusting entries are made?

Adjusting entries are usually made at the end of an accounting period. They can, however, be made at the end of a quarter, a month, or even at the end of a day, depending on the accounting procedures and the nature of business carried on by the company.

In all the examples in this article, we shall assume that the adjusting entries are made at the end of each month.

Types and examples of adjusting entries:

Adjusting entries can be divided into four types. Let’s briefly elaborate and exemplify each.

(1). Adjusting entries that convert assets to expenses:

Some cash expenditures are made to obtain benefits for more than one accounting period. These expenditures are known as capital expenditures (or CapEx, for short). Examples of such expenditures include advance payment of rent or insurance, the purchase of office supplies, office equipment, or another asset. These expenditures are initially recorded by debiting an asset account (such as prepaid rent, prepaid insurance, office supplies, office equipment, etc.) and crediting the cash account. This procedure is known as postponement or deferral of expenses. Once a capital expenditure has been made and recorded, an adjusting entry is made at the end of each period that gets the benefit from the related asset for converting an appropriate portion of the total cost of the asset into expense. Consider the following example to understand this procedure:

Example

On January 1, 2015, Moon Company paid $9,000 as advance rent for its head office building to Mr. X for the first quarter of the year. If the company makes adjusting entries on a monthly basis, the relevant journal entries are given below:

Entry on January 1, when the advance payment of rent is made:

Adjusting entry on January 31 to convert a portion of prepaid rent (an asset) to rent expense:

*Rent expense for one month:

= $9,000/3 months

= $3,000 per month

As the advance payment of $9,000 rent is for a full quarter (i.e., a three-month period), the adjusting entry made on January 31 will also be made at the end of the next two months (i.e., at the end of February and March).

Another very common adjusting entry that converts an asset into an expense is the recording of depreciation on fixed assets, because depreciation is the process of allocating an asset’s cost to the years of its useful economic life.

(2). Adjusting entries that convert liabilities to revenue:

Sometimes companies collect cash from their customers for which goods or services are to be delivered in some future period. Such receipt of cash is recorded by debiting the cash account and crediting a liability account known as unearned revenue. This procedure is known as the postponement or deferral of revenue. At the end of the accounting period, the unearned revenue is converted into earned revenue by making an adjusting entry for the value of goods or services provided during the period.

Example:

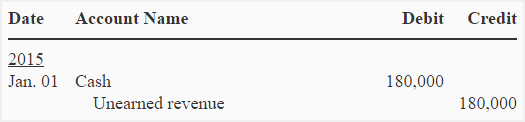

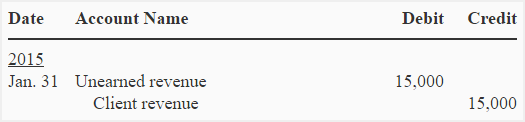

Moon Company receives $180,000 cash from Mr. Y, a regular client, on January 1, 2015. Until the end of January, the total value of the services provided to Mr. Y is $15,000. If accounts are adjusted at the end of each month, the relevant journal entries are given below:

Entry on January 01, when the advance payment is received from the customer:

Adjusting entry on January 31 to convert a portion of unearned revenue (a liability) to earned revenue:

(3). Adjusting entries for accruing unpaid expenses:

Unpaid expenses are those expenses that are incurred during a period but no cash payment is made for them during that period. Such expenses are recorded by making an adjusting entry at the end of the accounting period. It is known as accruing unpaid expenses.

Example:

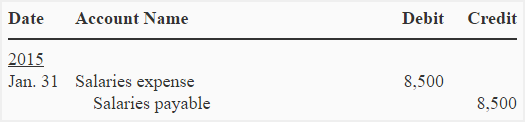

Moon Company pays salaries to its employees on the fifth day of every month. The total salary payable for the month of January is $8,500. If the company makes adjusting entries at the end of each month, it will record the following adjusting entry on January 31:

Adjusting entry on January 31:

(4). Adjusting entries for accruing uncollected revenue:

Uncollected revenue is revenue that is earned during a period but not collected during that period. Such revenues are recorded by making an adjusting entry at the end of the accounting period. It is known as accruing the uncollected revenue.

Example:

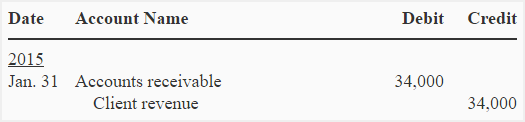

Moon Company provides services valued at $34,000 to Mr. Z during the month of January. Mr. Z will be billed next month. The company will record this accrued revenue by making the following adjusting entry:

Adjusting entry on January 31:

After preparing all necessary adjusting entries, they are either posted to the relevant ledger accounts or directly added to the unadjusted trial balance to convert it into an adjusted trial balance. Click on the next link below to understand how an adjusted trial balance is prepared.

ACCUNTING FOR INTANGIBLE ASSETS AND GOVERNMENT GRANTS+