Activity method of depreciation

Under activity method, the depreciation expense is calculated on the basis of asset’s actual operational activity such as the number of units produced or the number of hours the asset has used during the period. In other words, this method focuses on the real use of the asset in production process rather than just the passage of time. Other names used for activity method of depreciation are variable charge approach and units of output method.

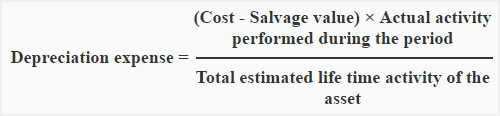

Formula:

The following formula is used for calculating depreciation expense under activity method of depreciation:

Example 1:

The American company purchased a wheel loader for $150,000 on January 1, 2022. The information regarding usability and life of the loader is given below:

- Estimated salvage value: $10,000

- Estimated useful life: 10 years

- Estimated productive life in hours: 20,000 hours

- The wheel loader was used for 2,000 hours during the year 2022.

Required: Calculate depreciation expense for the year 2022 using activity method of depreciation.

Solution:

Depreciation expenses = [($150,000 – $10,000)/20,000] × 2,000

= $14,000

The company will record a depreciation expenses of $14,000 for the year 2022. The wheel loader will be fully depreciated after completing 15,000 hours of work – that is its productive life.

Example 2:

The Southern company uses a delivery truck whose cost is $50,000 and the salvage value is zero. The truck has been driven 12,500 miles during the year 2022. The company plans to retire the truck after it has been driven 250,000 miles.

Required: Calculate depreciation expense of the Southern company for the year 2022 resulting from the use of delivery truck.

Solution:

Depreciation expenses = ($50,000 /250,000) × 12,500

= $2,500

Activity method is excellent in matching expense with revenue in situations where service efficiency of the asset is decreased by its use. Examples of such assets include vehicles and machines. This method is suitable for companies that desire high depreciation during the years of high productivity and low depreciation during the years of low productivity.

Limitations of Activity method:

Activity method of depreciation suffers from the following limitations:

- Its use is not appropriate for assets whose depreciation is a function of time instead of activity.

- This method uses units of output or hours used which are usually difficult to estimate.

Leave a comment